How-Tos and FAQs for Businesses

Here you'll find tutorials and FAQs related to business banking topics. You'll also find more resources, including user guides, on our Business Digital Banking and Cash Management Resources page.

Manage Users How-Tos

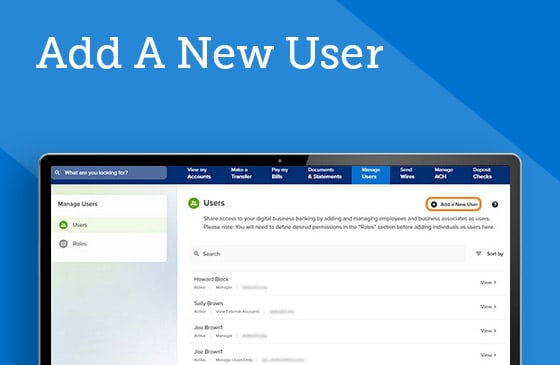

Add A New User

Share access to your digital business banking by adding employees and business associates as users.

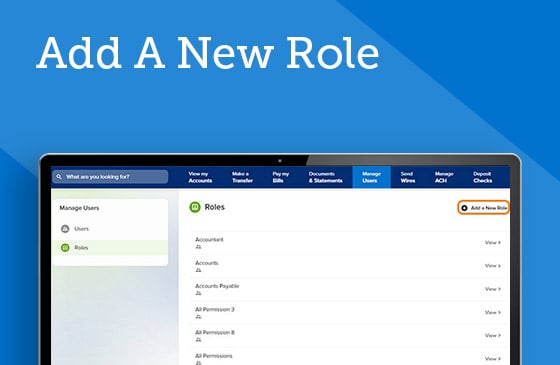

Add A New Role

Create roles that grant users permission to perform a variety of tasks in your digital business banking.

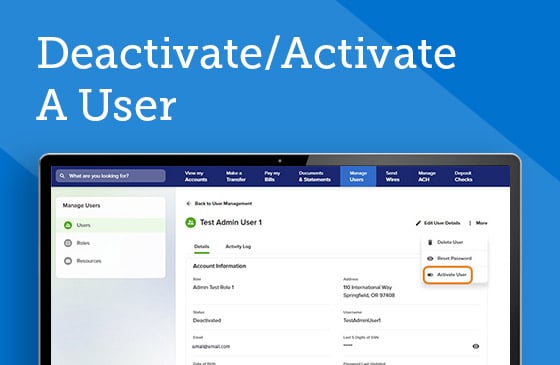

Deactivate/Activate A User

Temporarily deactivate, not delete, a user from your digital business banking.

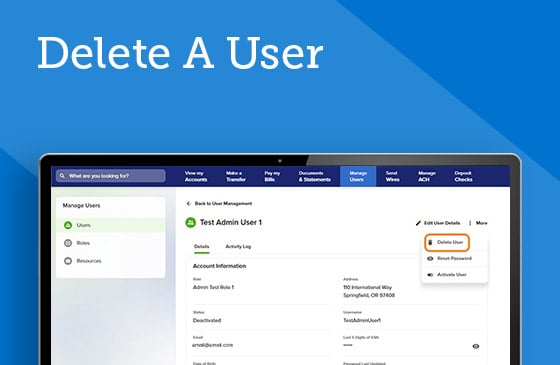

Delete A User

Remove a user from your digital business banking account. This action can't be reversed.

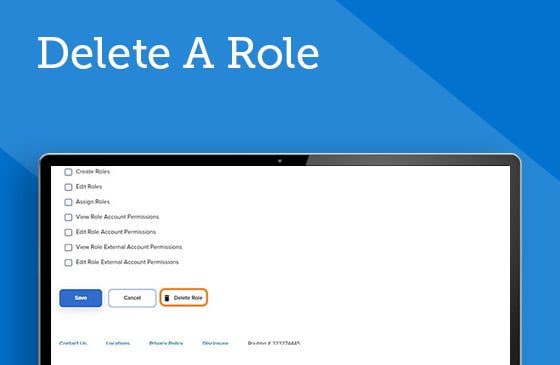

Delete A Role

Remove a role that’s no longer needed in your business banking account.

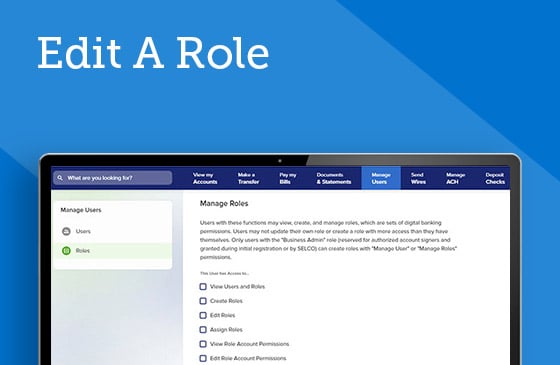

Edit A Role

Users with the Business Admin role and associated permissions may edit existing users' roles.

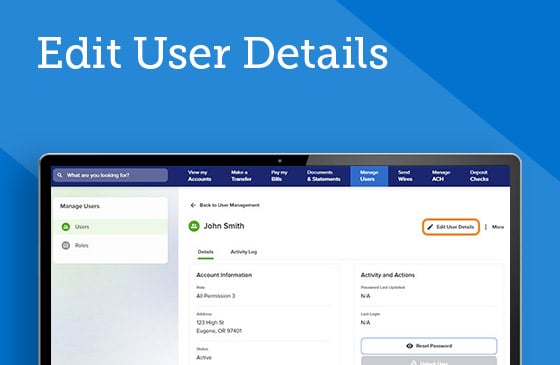

Edit User Details

Modify user profile information such as address and phone number in a few easy steps.

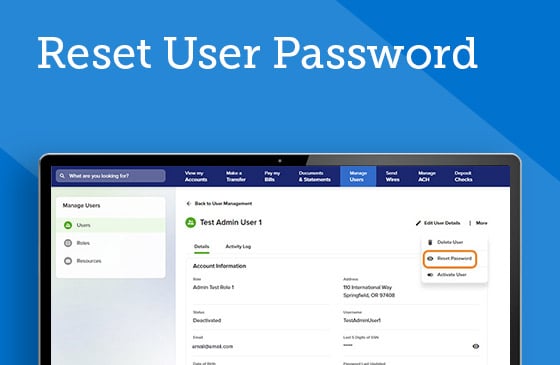

Reset User Password

The Business Admin or other user with appropriate permissions can provide login support to users.

Manage ACH How-Tos

Create ACH Templates

Design templates to organize the different types of ACH payments you make for your business.

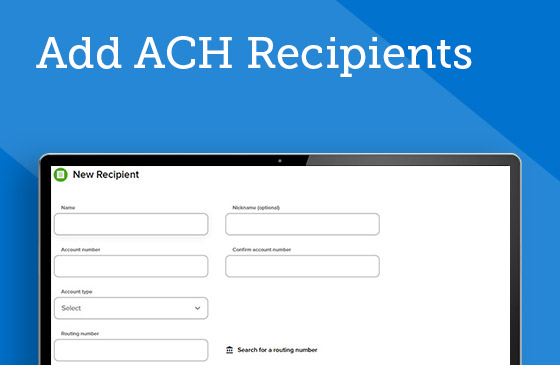

Add ACH Recipients

Enter new recipients’ payment information to add to your templated payments.

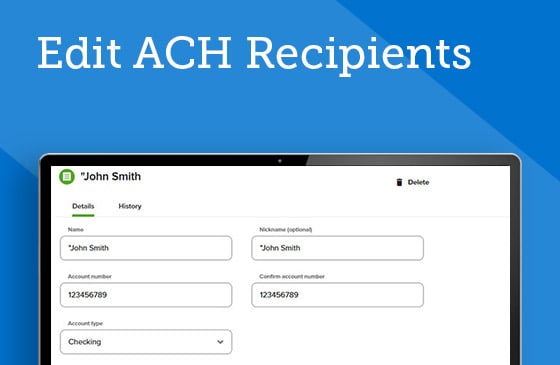

Edit ACH Recipients

Modify existing recipients’ information and remove recipients you no longer need.

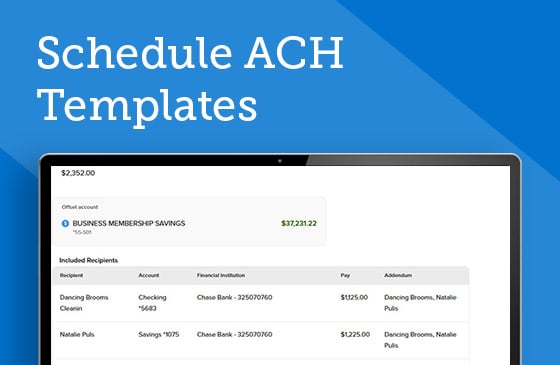

Schedule ACH Templates

Set and forget recurring transfers or schedule one-time payments to other businesses.