Payments & Transfers

Make a Loan Payment With a Card

Use a debit or credit card from an external institution to make loan payments.

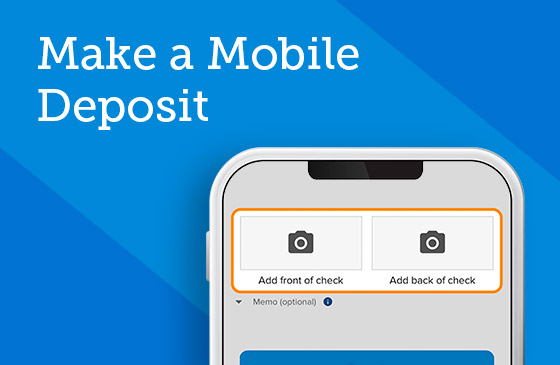

Make a Mobile Deposit

In just a few steps, deposit checks into one of your deposit accounts using your device’s camera.

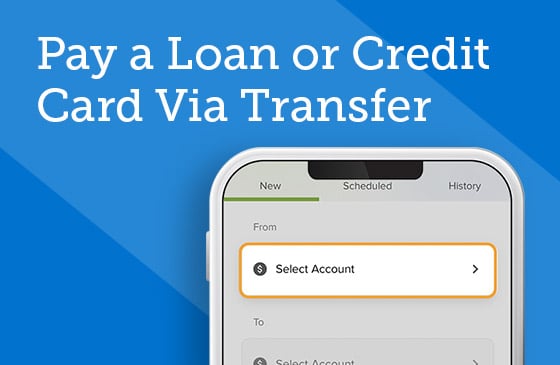

Pay a Loan or Credit Card Via Transfer

Set recurring payments or send one-time installments to your SELCO loan(s).

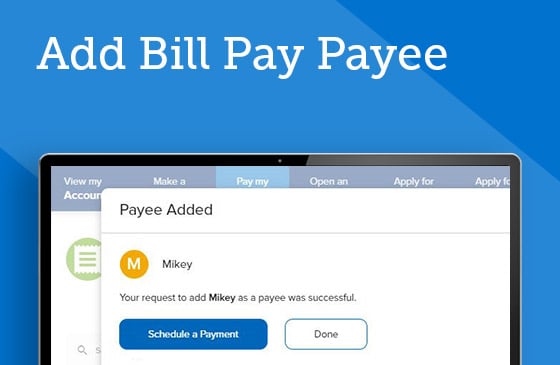

Add Bill Pay Payee

Organize your bills by setting payees through the Bill Pay function of digital banking.

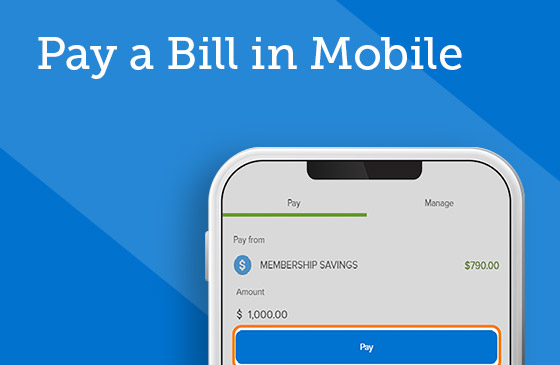

Pay a Bill in Mobile

See how easy it is to pay your bills using Bill Pay from your mobile device in digital banking.

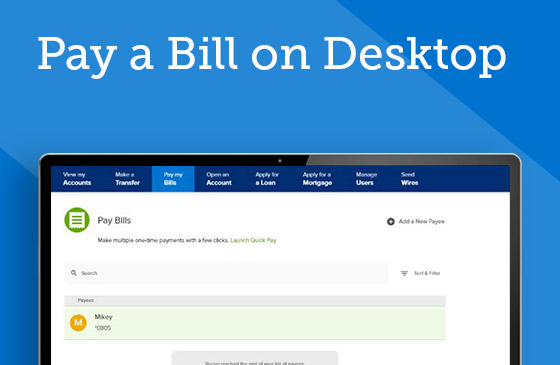

Pay a Bill in Desktop

Quick and simple steps on how to pay your bills on your desktop computer in digital banking.

Transfer to Another Member

With a few taps on your device, transfer funds to any SELCO member, any time.

Transfer Between Accounts

Set and forget recurring transfers or quickly move money between your accounts.

Transfer to Another Institution

Schedule one-time and recurring transfers to your non-SELCO accounts.

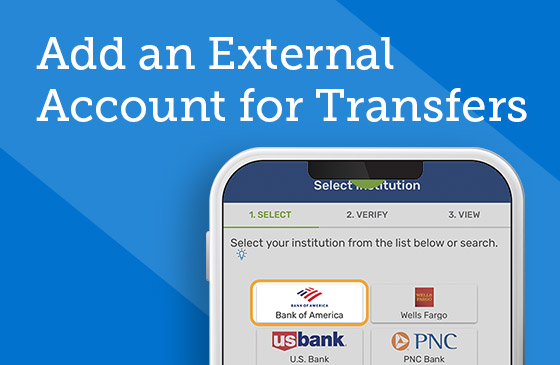

Add an External Account for Transfers

Set up external institutions that you’d like to transfer money to and from your SELCO account.

View Scheduled Bill Payments and History

Get a full accounting of bills that have gone out and will go out.

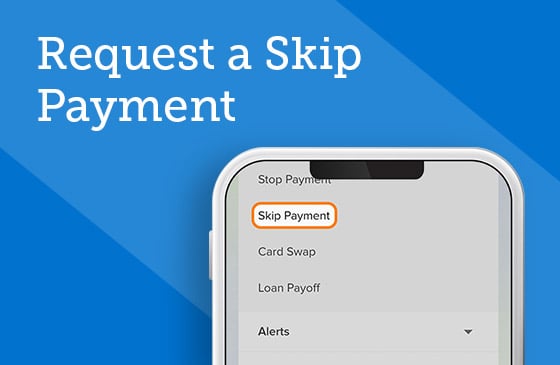

Request a Skip Payment

Request up to two skip payments over a rolling 12-month period on your qualifying SELCO loans.

Find Your Routing & Account Info

Quickly locate SELCO’s routing number and your account information.

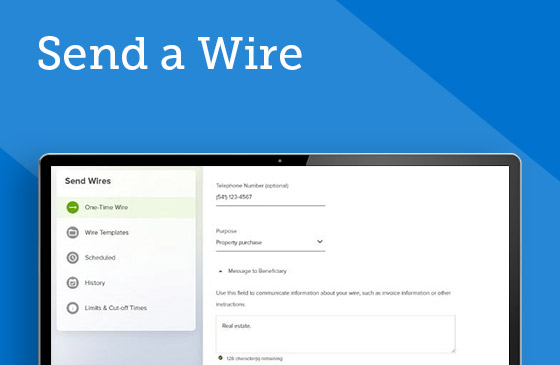

Send a Wire

What you’ll need to know to wire money within and outside the US.

Manually Add An External Account for Transfers

Manually set up external institutions that you’d like to transfer money to and from your SELCO account.