Link Digital Checking

How to earn your monthly round-up match

Select your benefits

- Enroll in eStatements (required).

- Opt in to round-up savings (required to earn round-up match).

- Connect Link to a savings account or credit card for free overdraft transfers and/or opt in to Expanded Courtesy Pay for enhanced free overdraft protection.

Set up automatic monthly deposits

Deposit $250 or more each month through payroll direct deposit or ACH transfers.

Use your debit/credit card

Use your SELCO debit or credit card to make at least 12 purchases each month (required to earn round-up match).

Access free financial advice

With Link, you also have free access to GreenPath's confidential, certified financial counselors. Through 1:1 consultations, they'll help you define your financial goals and build an action plan to reach them.

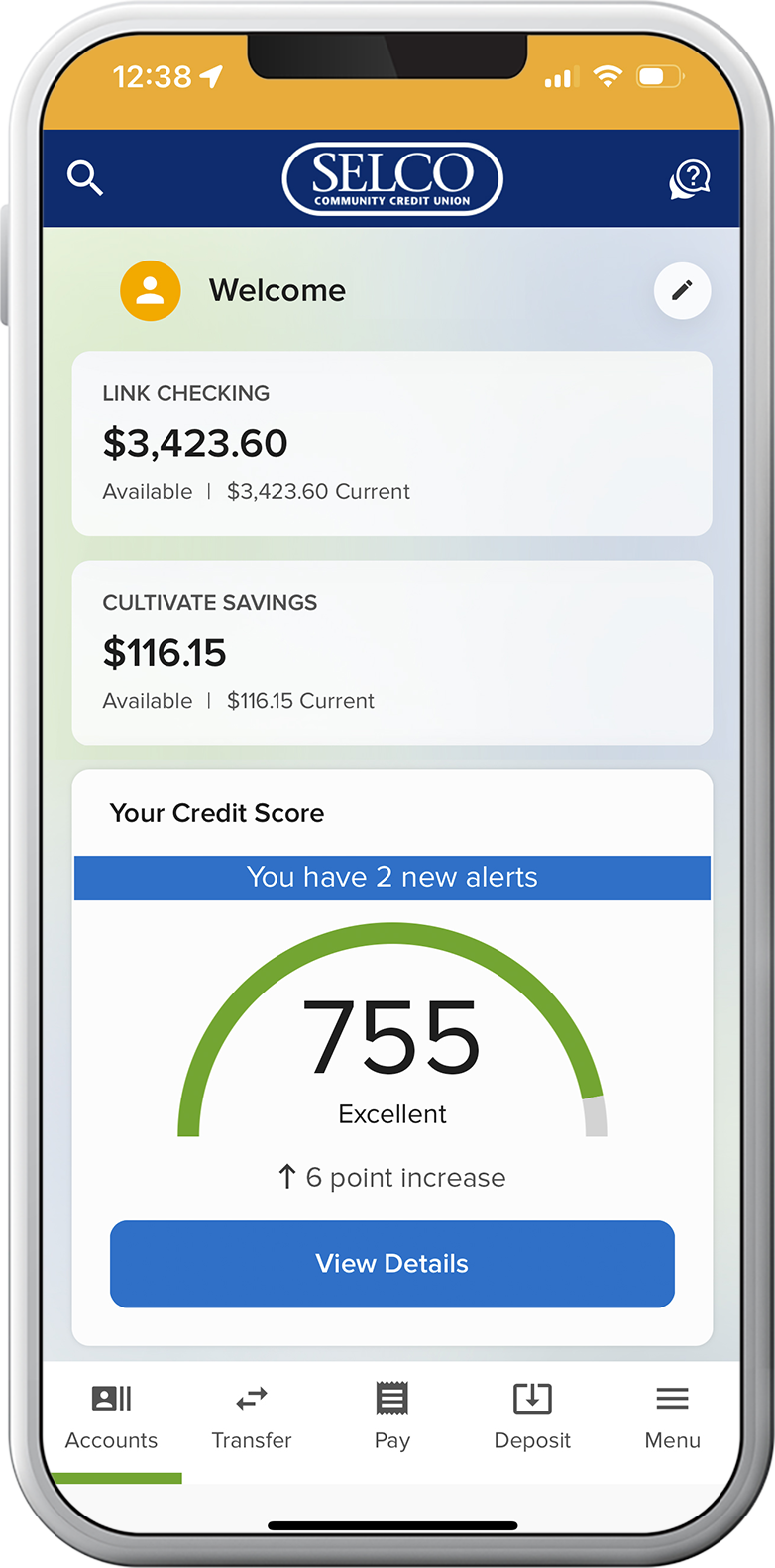

A better banking app

Complete your day-to-day transactions and more—securely from wherever, whenever.

Mobile wallets and card controls

Add cards to your mobile wallet, turn cards off/on, set spending limits, create transaction alerts, and more.

Payments and transfers

Easily connect your SELCO and other accounts to securely transfer money. You can also send money to family and friends with Zelle®.*

Free credit monitoring

See your credit score in real time. You’ll even get personalized feedback on ways to boost your score.

*Zelle® and the Zelle® related marks are wholly owned by Early Warning Services, LLC and are used herein under license.