Youth Checking

Simple and convenient features

- 30,000+ free ATMs nationwide to withdraw cash.

- SELCO Visa® debit card to make payments directly from your checking account.

- Check your balance, deposit checks, transfer funds, and pay your bills from any device, 24/7.

- No monthly fees or minimum balance requirements.

- Accounts insured for up to $250,000 by the NCUA.

Two youth checking account options

Link Digital Checking is a connected rewards account with free overdraft protection and waived ATM fees. Plus, earn monthly round-up savings matches (up to $7) by meeting digital deposit and debit card purchase requirements.

Learn More About Link Checking

Select Checking is a traditional checking account with no monthly service charge or balance requirements, and an optional interest-bearing upgrade. Check your balance, deposit checks, transfer funds, and pay your bills from any device, 24/7.

Learn More About Select Checking

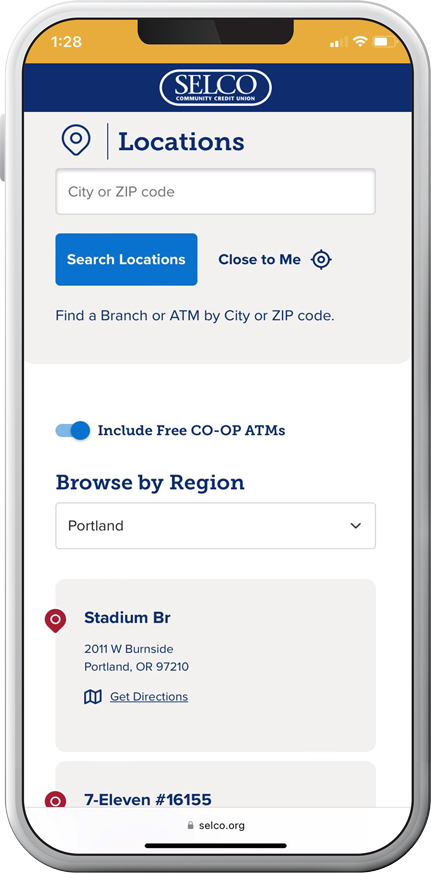

Access funds at 30,000+ free ATMs

With more than 30,000 free ATMs nationwide, you can access your funds wherever you are, with no out-of-network fees. Find the closest fee-free ATM near you by navigating to the Locations link located at the bottom of your mobile app screen after tapping Menu. Or you can always visit a Costco, 7-Eleven, or Circle K for a fee-free ATM.

Ready for your first checking account?

All you need to do is bring a parent or guardian and the following to any branch. (Note: Youth Checking Accounts are for ages 13-17 with an adult on the account.):

- A photo ID (current student IDs are OK).

- Proof of current address.

- Social Security numbers for you and your parent or guardian.

- A minimum of $10 ($5 to join, $5 to put in your account).

Resources

How Students Can Keep Money in their Pockets

Making a monthly budget can take a bit of time and thought, but it’s worth it. Here are five tips to help students keep money in their problems.

Generation Z and the Minefield of Online Scams

Young people's familiarity with technology—specifically, social media—can create a false sense of security when they are targeted by online scams.

Mentally Prepare to Ace That Job Interview

Do you have a big interview coming up? While there is no one-size-fits-all solution, you might want to look at some of these tips.

The Financial Mistakes of Our 20s and 30s

Start saving for retirement when you get your first job and you’ll develop a healthy savings habit that will serve you well down the road.