Digital Banking

One app, your full financial picture

Mobile wallets and card controls

Add cards to your mobile wallet, turn cards off/on, set spending limits, create transaction alerts, and more.

Payments and transfers

Easily connect accounts to securely send money between them or to other institutions. You can also send money to family and friends with Zelle®.*

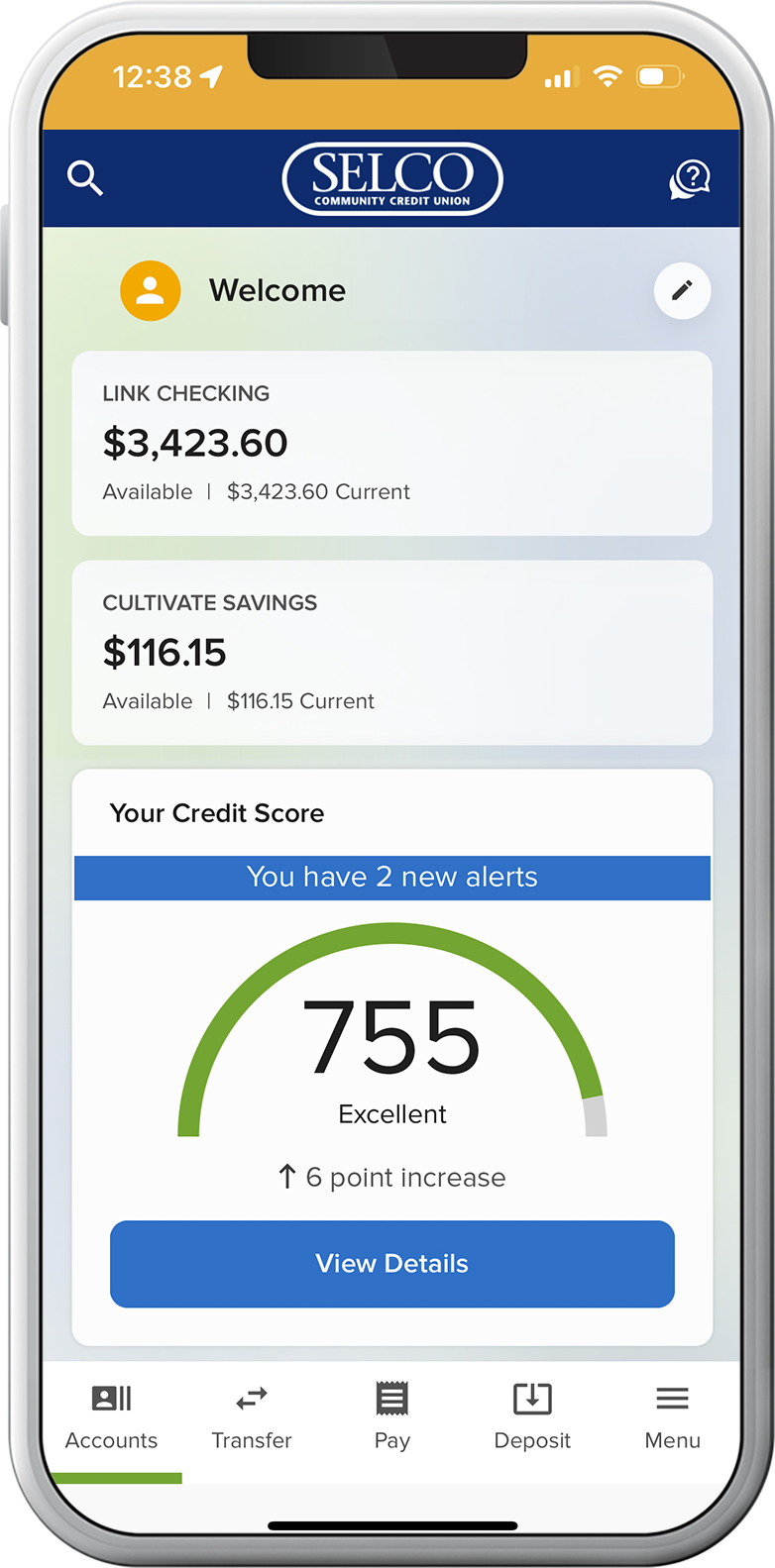

Free credit monitoring

See your credit score in real time. You’ll even get personalized feedback on ways to boost your score.

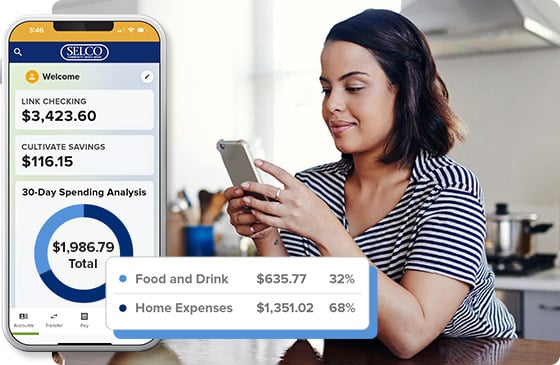

Budgeting and savings tools

Track your spending by category and see how your habits have changed over time. When you’re ready to work toward your next big purchase, create a savings goal to adjust your incoming funds.

Categorize and analyze spending

Stay on top of your purchases with our free Spending Analysis tool:

- Automatically assigns categories to your transactions.

- Displays transactions in a graph to visualize your spending.

- Shows how your spending history has changed over time.

- Forecasts how much money you’ll have in the future so you can plan ahead.

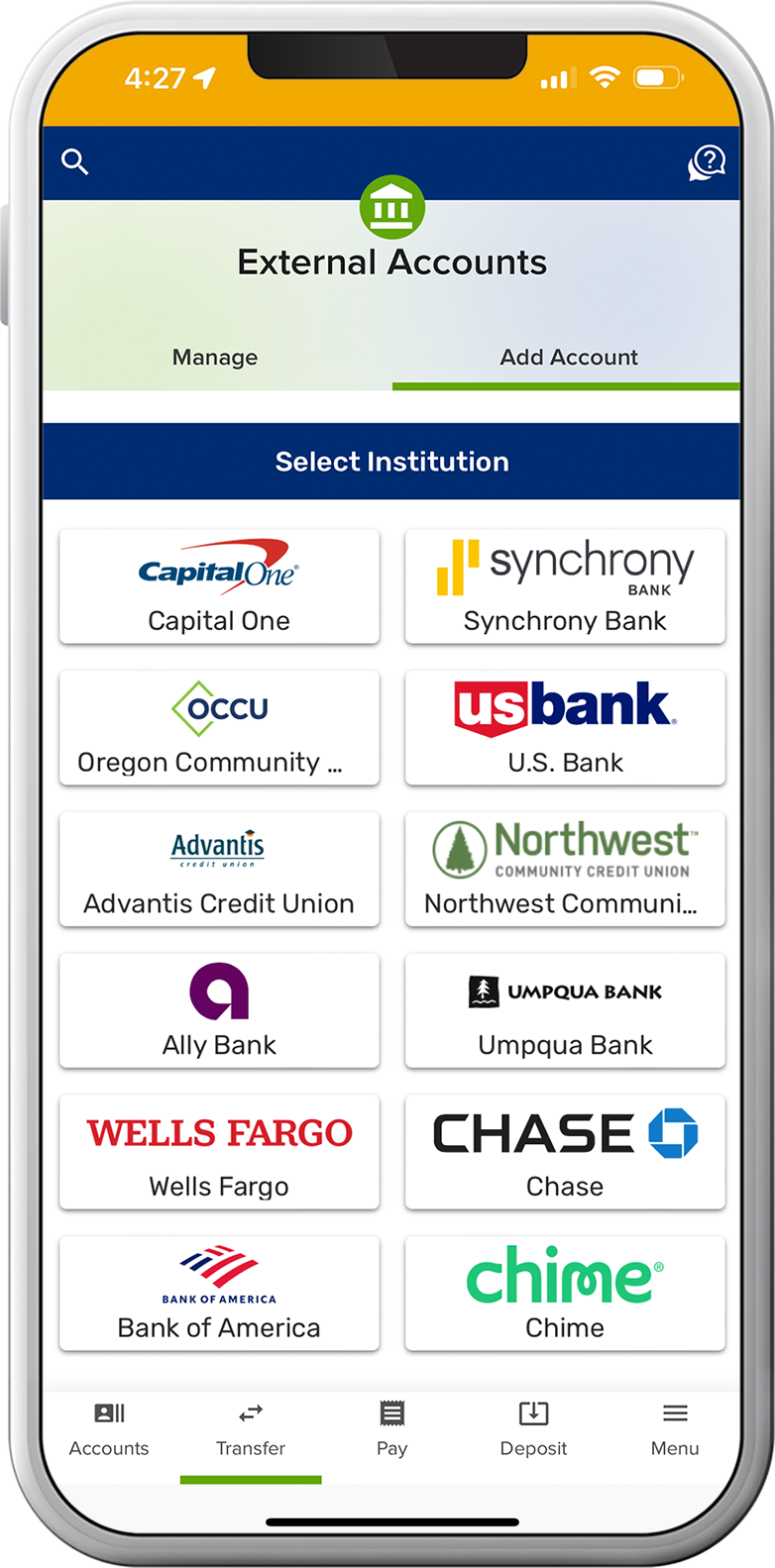

Payments and transfers

Digital banking has secure and streamlined transfer options for however you prefer to move money.

Add external accounts

Connect external accounts to transfer money to your SELCO accounts and loans.

Make loan payments

Set up one-time or recurring payments using internal or external transfers. You can also pay SELCO loans with a non-SELCO debit or credit card.

Pay bills

Manage your bills in one central location by scheduling one-time or recurring payments to companies and individuals.

Send money with Zelle®

Whether you’re splitting the cost of a meal, gift, or trip, Zelle® makes it easy to pay your share.*

Automate savings goals

Hit your savings goals (and develop savings habits) with automated, recurring transfers.

Secure your cards from potential fraud

Manage your cards wherever you are with these integrated controls:

- Turn your cards off and on instantly.

- Easily activate a card, report a card lost/stolen, or request a new card.

- Set controls and alerts by amount or transaction type.

- Add travel notices to prevent declines when you’re away from home.

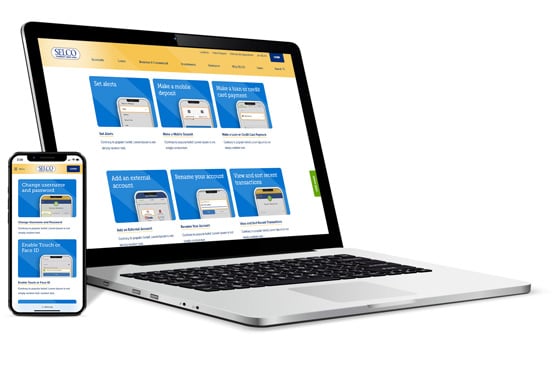

How-Tos and FAQs

Looking for tips on making the most of your upgraded digital banking experience? We’ve got you covered with step-by-step walkthroughs and more.

¿el español es tu idioma preferido?

Alterne fácilmente entre inglés y español: su preferencia se guardará la próxima vez que inicie sesión.

Easily toggle between English and Spanish—your preference will be saved the next time you log in.

Resources

What To Know About ‘Buy Now, Pay Later’

Choosing a "Buy Now, Pay Later" option at check-out is so easy, it almost seems too good to be true. Learn the pros and cons of using these services.

Make Your Life Easier with Peer-to-Peer (P2P) Payments

Whether you're hitting the road or enjoying a fun night out, use Zelle® to easily split the costs with friends and family, right from our app.

Tips For Successful ACH Transfers

While ACH transfers can be quick and convenient ways to send and receive money, there are a few steps to ensuring smooth and timely ACH transfers.

SELCO Digital Access: Secure, Quick, and Simple

SELCO offers a variety of digital tools that allow you to manage your accounts anywhere, anytime. Think of our digital tools as your virtual branch.

*Zelle® and the Zelle® related marks are wholly owned by Early Warning Services, LLC and are used herein under license.