Help and Support

Your one-stop shop for tutorials, tips, and FAQs for making the most of your SELCO accounts.

Search Help & Support Resources

Search Help & Support Resources

Featured How-To Resources

Sign on for the First Time

Easily make the transition from online/mobile banking to digital banking.

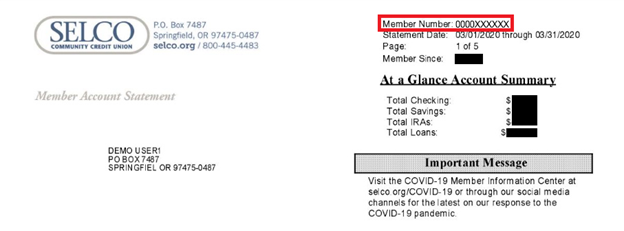

Register for Digital Banking

Sign up as an individual or business in a handful of easy steps.

Customize Your Dashboard

Organize your digital banking dashboard however you’d like.

Enable/Disable the Quick Balance Widget

Quick Balance lets you see your account balances without logging in.