Security and Account Alerts

Keep tabs on your accounts

Customize what alerts you receive and when.

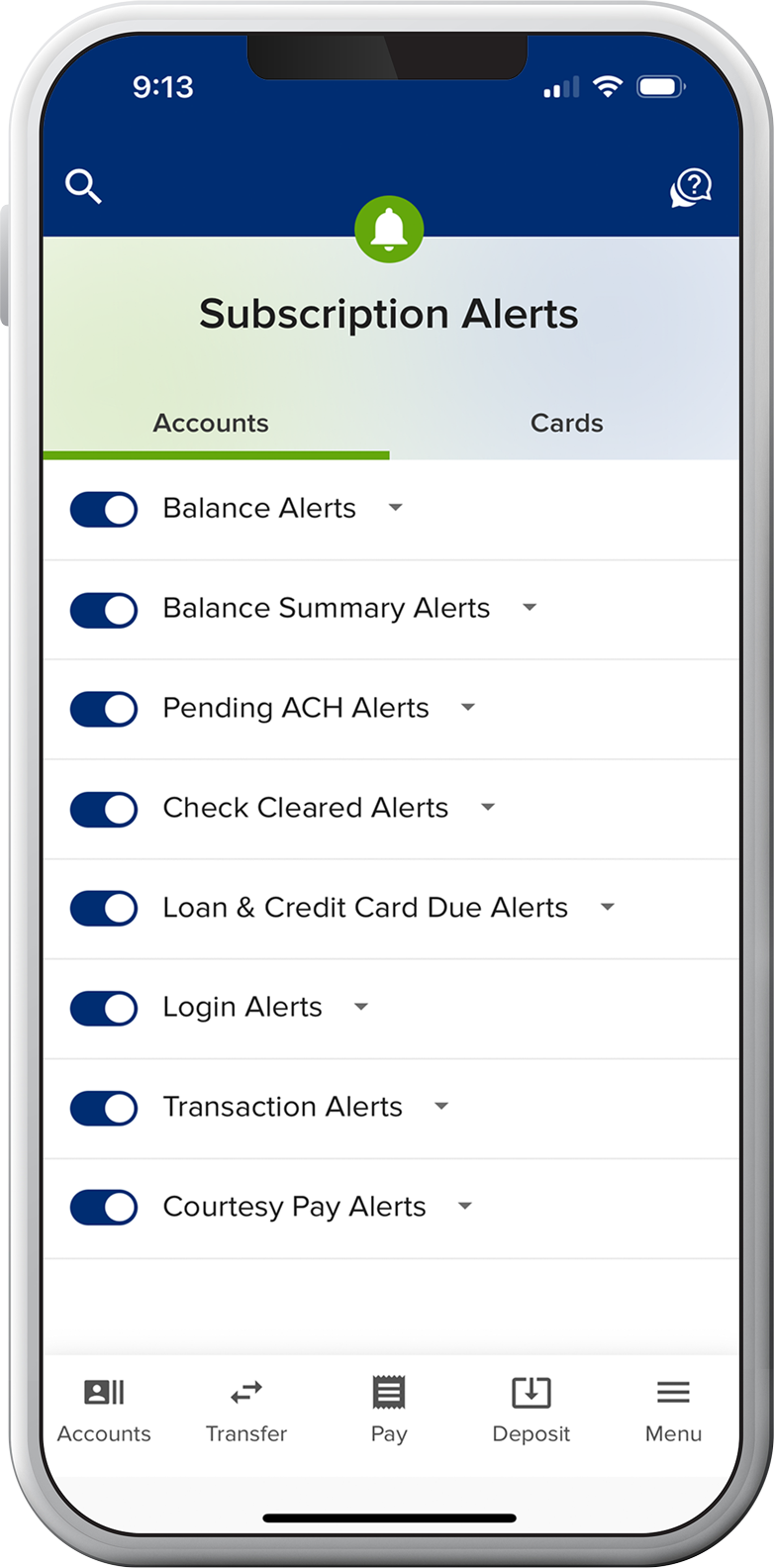

Turn on real-time alerts

Customize notifications for transaction, login, and balance activity.

Create advanced card alerts

Go a step further by setting alerts and spending limits for specific cards, merchants, and transaction types (e.g., online or in-person).

Enable security alerts via text or push

Update your security alert destinations to be notified of suspicious digital banking activity via text or push notifications (email is enabled by default).

Log in securely

Paired with a strong password, these tips can take your account security to the next level.

Set up Fingerprint/Face ID

Access digital banking quickly, securely, and uniquely with your biometric login.

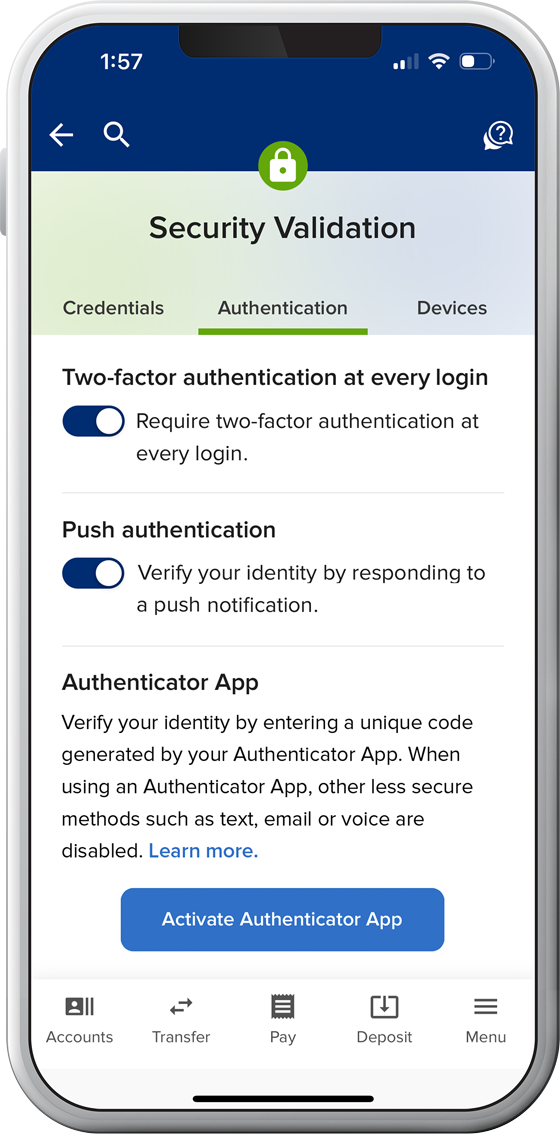

Customize and enhance your authentication

Opt in to push authentication to boost your security and authenticate with the tap of a button (SELCO mobile app required). Alternatively, switch from receiving text/phone security codes to using an authenticator app of your choice.

Resources

Tips for spotting scams

Learn how to identify fraud and recognize red flags to stay one step ahead of fraudsters.

Visit Security Center

Security and privacy how-tos

Review account features and the steps you can take to help protect yourself from fraud.

View How-To Resources