By now, most of us have heard about “romance scams” that target individuals looking for companionship or to give a family member a hand (these are also known as “distant relative scams”). Such scams are well known because they’ve been around a long time—and because they’re effective.

Romance scams and other versions of the “advance-fee scam” can be traced back to the “Spanish prisoner swindle” of the 19th century, and more recently the infamous “Nigerian prince” scam that took on new life with the advent of the internet. In all of them, fraudsters promise a share of their “wealth” in return for helping them out of a sticky situation by sending money to a fraudulent account.

Romance scams and other versions of the “advance-fee scam” can be traced back to the “Spanish prisoner swindle” of the 19th century, and more recently the infamous “Nigerian prince” scam that took on new life with the advent of the internet. In all of them, fraudsters promise a share of their “wealth” in return for helping them out of a sticky situation by sending money to a fraudulent account.

Today’s version of the romance scam is no different—and arguably more perilous because of evolving methods and advanced technologies. The scam can even escalate to the point of emptying out accounts. Unfortunately, reports of romance scams are on the rise, and the numbers are staggering—from 2021 through 2023, there were 215,000 cases reported with total losses exceeding $3.8 billion.

Let’s explore how romance scams work and how you can protect yourself from falling victim.

How do romance scams work?

In many cases, criminals will troll online dating sites, social media, even gaming sites, looking for individuals who seek an emotional connection. The scammers even seek out unsuspecting victims through unsolicited “wrong number” text messages. A list compiled by the Federal Trade Commission reveals that the most common lies told by scammers include:

- “I or someone close to me is sick, hurt, or in jail.”

- “I can teach you how to invest.”

- “I’m on an oil rig or ship.”

Once trust is established, the scammer will typically request a small sum of money to cover things like travel expenses to see the victim, medical care, or a business opportunity. Gradually, as the victims become more comfortable with their newfound companionship, the scam builds to the point where victims are asked to send large sums of money to someone they’ve only met online.

“People prey on that emotional connection,” said Stephanie Ziegler, Senior Financial Investigations Manager at SELCO. “And that connection is really hard to break once established.”

How can you protect yourself?

Romance scams can be stopped cold if steps are taken early. Arm yourself with these tips in the event that a romance scam comes your way:

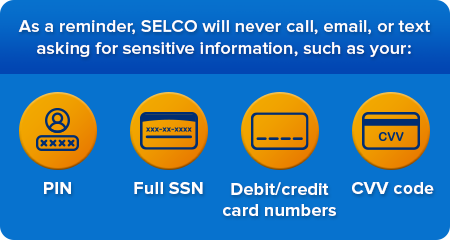

- NEVER give out personal information. The biggest red flag is when someone you don't have a longstanding, trusted relationship with asks for your account information. That’s a sure sign of a scam, and you should step away.

- NEVER send money or gifts to someone you haven’t met in person or seen for a long time. People you know and trust wouldn’t ask you to send money, gift cards, cryptocurrency, or put money on a reloadable debit card. The fact that the scammers operate nearly exclusively through digital is a huge warning signal.

- Verify the person’s identity. These scammers often use deepfake and artificial intelligence tools to create an identity. Or they may have stolen someone’s photo to use as their own profile photo. If they provide a photo, a good place to start is Google’s image search. Requesting a video call with anyone new who wants to befriend you may also help you verify someone’s identity. But be careful with this approach, as some scammers may personally groom victims in the hope of getting more money over time.

- Be wary of requests to move to a more secure channel. If a new “friend” wants to shift your conversations away from the original point of contact and into a fully encrypted channel like WhatsApp or Google Chat, that’s a red flag. Yes, these are legitimate ways to communicate, but fraudsters tend to take advantage of the end-to-end encryption because it makes it harder for law enforcement to identify them.

- Step back and question their story … because they’re often outrageous. As mentioned earlier, the “oil rig” story is a fine example of a “This can’t be real, right?” In this story, they claim they’re unable to access their accounts and need victims to send money for them. The scam is very common and should give you pause.

It’s also a good idea to file a complaint with your local law enforcement or the FBI’s Internet Crime Complaint Center.

And perhaps most importantly, if you fall victim to a romance scam—or even sense that something doesn’t feel right with your, or a loved one’s, situation—don’t hesitate to reach out to someone close to you or your financial institution. A healthy dose of skepticism can go a long way toward eliminating the threat.

“It's always a good idea to look at any request from someone you’ve met online from the viewpoint of someone else,” Ziegler said. “Fraudsters use emotion to cloud the judgment of victims and help distract from the red flags in their stories. Looking at a situation objectively, or sharing it with someone else, can help remove some of the emotion and shine a light on the inconsistencies a fraudster is hoping their victims don’t notice.”