They’re so easy to use, they almost seem too good to be true. Is there a catch?

With Buy Now, Pay Later (BNPL) services, you can walk away with that expensive exercise bike, entertainment system, sectional sofa, or anything else that catches your eye, even if you can’t cover the costs in the moment. And in return, retailers can make more sales by getting these expensive items into the hands of more consumers—often regardless of income levels.

These services are easily accessible, which has led to wide consumer adoption. By 2025, the industry is projected to accumulate $680 billion in transaction volume. Let’s take a look at this phenomenon, how it works, and what to be aware of before you give it a try.

How ‘buy now, pay later’ works

Have you ever gotten lost shopping online, then, when it’s time to check out, you notice that the total is a little higher than you’d like to spend? Enter Buy Now, Pay Later. This option will link you to a BNPL app, such as Afterpay, Klarna, Affirm, or Quadpay at check-out. BNPL has become so popular that even brick-and-mortar stores have begun offering this option.

You can think of these services as a point-of-sale loan. Here’s how it works:

- Approval. If you choose a BNPL option, you’ll first need to get approved. Eligibility is easy—apps usually run a soft credit check to confirm your information. Once approved, you can choose to link your debit or credit card or checking account so the app can collect the payments when they’re due (usually every two weeks or once a month).

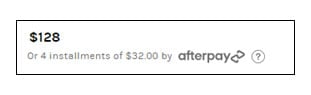

- Make an initial payment. You'll typically make a first payment (usually 25%) on the purchase. Most BNPL plans require you to pay off the rest in three fixed installments, but payment schedules can vary.

- Complete the purchase. Now the item is yours!

“Sounds like a credit card,” you might be thinking. And in some ways, it is similar. Unlike credit cards, however, there are no interest charges for paying via BNPL, no fees for using the service (unless you miss a payment), and no hard-pull credit checks to qualify.

Downsides of BNPL

While you don't have to worry about interest charges or other fees with BNPL services, their convenience can be risky. Before clicking on the BNPL option, it’s important to be aware of the potential pitfalls:

- It can encourage impulse purchases. This is perhaps the biggest danger. Whether it’s clothing shopping or browsing your favorite online furniture store, BNPL makes those purchases you hadn’t planned for all too convenient.

- Missed payments are heavily penalized. If you miss a BNPL payment, the honeymoon is over. Some services will slap an interest charge on your outstanding balance, with rates as high as 40%. Other programs will charge a one-time late fee, which can be as high as $39. And others may tack on an extra fixed fee to all remaining payments. Missed or late payments may also appear on your credit report, potentially lowering your score. Make sure you read the app’s terms and conditions (usually called an “Installment Agreement”) before agreeing to pay into the service. These are usually found at checkout linked next to the service (screenshot below).

-

Monthly payments can stack up quickly. For some people, getting too comfortable using BNPL can mean the beginning of the end of their financial responsibility. If you’ve purchased multiple items through BNPL programs, the combined monthly payments won’t be so minimal. These payments will need to be factored into your monthly budget and can eat into other categories, like savings.

When to choose BNPL

The primary advantage of paying through a BNPL service is that you can purchase an expensive item even if you don’t have the cash at the time. This is especially handy if you have an urgent purchase (like medical equipment not covered by insurance) that you may not be able to afford right now.

In addition, spreading out the cost of a purchase can be convenient for workers with an uneven income flow, such as independent contractors and freelancers.

Buy Now, Pay Later programs can be super convenient, but they also present risks for the uninformed or distracted buyer. Do your own research before using one of these programs, read the installment agreement, and be sure your budget can handle multiple monthly payments if you plan to regularly use BNPL.