Card Management & Alerts

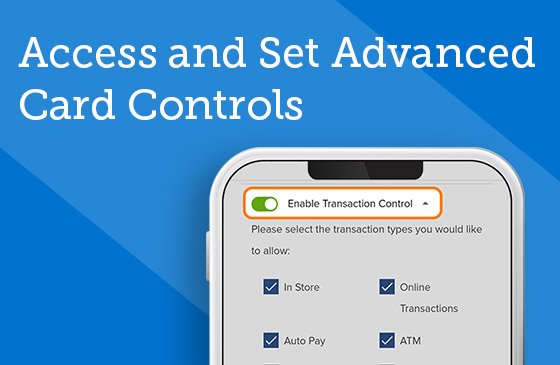

Access and Set Advanced Card Controls

Establish transaction limits, restrict transactions, or even suspend your cards.

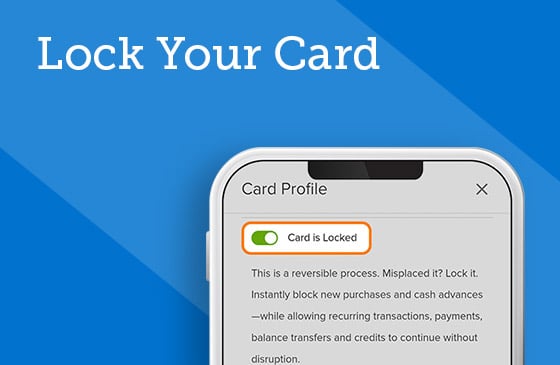

Lock Your Card

Instantly block new purchases and cash advances if your card has been misplaced or stolen.

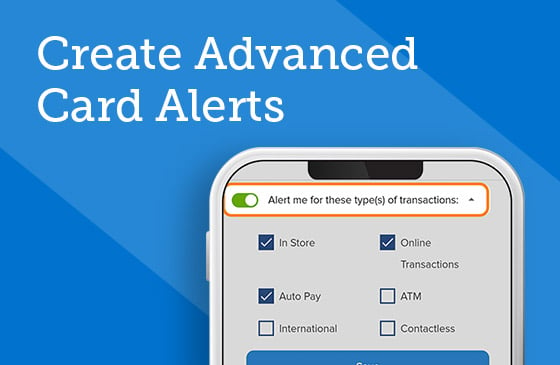

Create Advanced Card Alerts

Receive notifications when certain transactions are made and your card is declined.

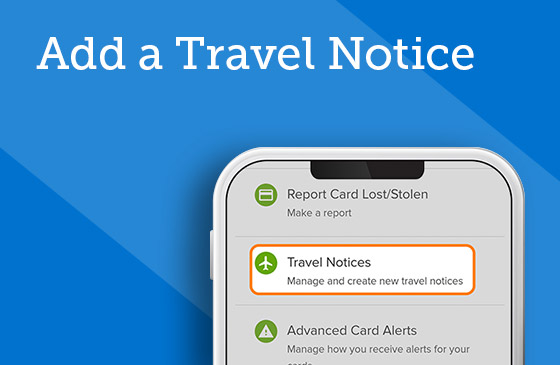

Add a Travel Notice

Enter trip details, like where you’re going and how long you’ll be gone, to reduce possible declines.

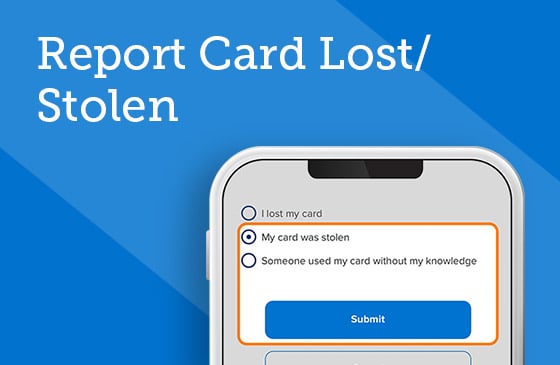

Report Card Lost/Stolen

Cancel your misplaced or stolen card and order a replacement within seconds.

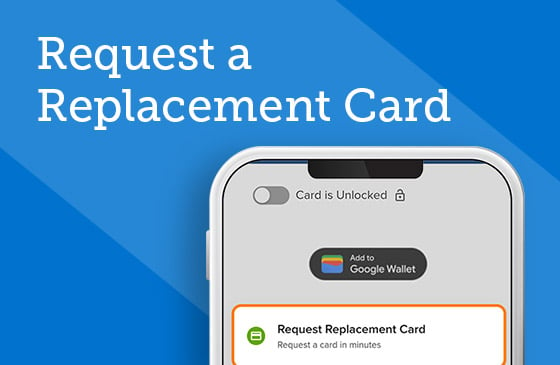

Request a Replacement Card

Place an order for a new debit or credit card with just a few taps on your device.

View Credit Card Statements

Go paperless for digital access to your monthly credit card statements.

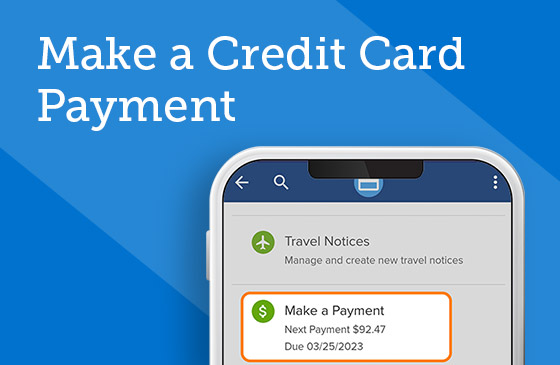

Make a Credit Card Payment

Set recurring payments or send one-time installments to your credit card account.

Add Card to a Mobile Wallet

Set a digital payment option by adding your debit or credit card to a mobile wallet.

Activate Your Card

Skip the trip to a branch by activating your debit or credit card right in digital banking.

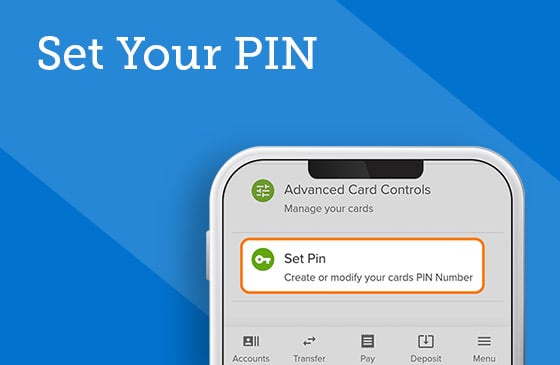

Set Your PIN

Set your personal identification number (PIN) for your cards in a few easy steps.

Set Transaction Alerts

Receive email or text alerts when checks clear, loans are coming due, suspicious activity occurs on your account, and more.

Update Multiple Payments at Once

A convenient place to designate your SELCO card to be used for payments to merchants.