Payments & Transfers

Transfer Between Accounts

Set and forget recurring transfers or quickly move money between your accounts.

Transfer to Another Institution

Schedule one-time and recurring transfers to your non-SELCO accounts.

Transfer to Another Member

With a few taps on your device, transfer funds to any SELCO member, any time.

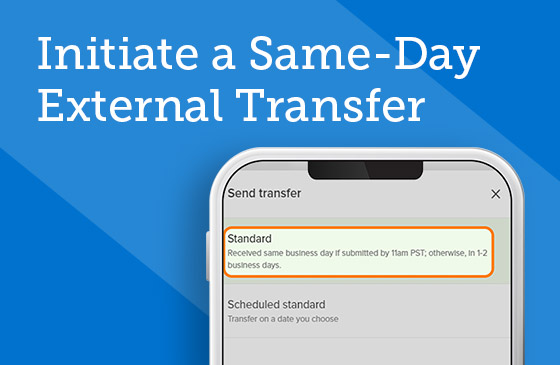

Initiate a Same-Day External Transfer

Move money between institutions quickly by choosing a standard same-day transfer.

Enroll With Zelle®

Zelle® is available in the SELCO app, so there’s no need to download another app.

Send Money With Zelle®

Use Zelle® to gift money, pay the sitter, or split the cost of dinner, right from our app.

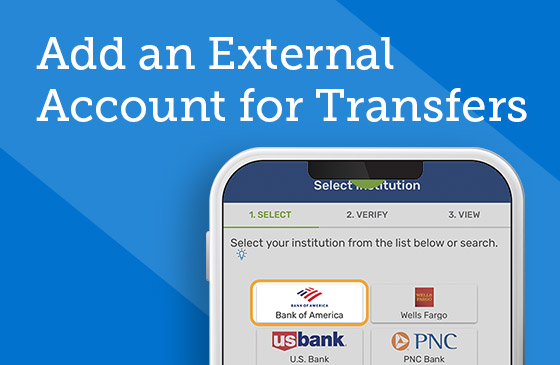

Add an External Account for Transfers

Set up external institutions that you’d like to transfer money to and from your SELCO account.

Manually Add External Account for Transfers

Manually set up external institutions that you’d like to transfer money to and from your SELCO account.

Send a Wire

What you’ll need to know to wire money within and outside the US.

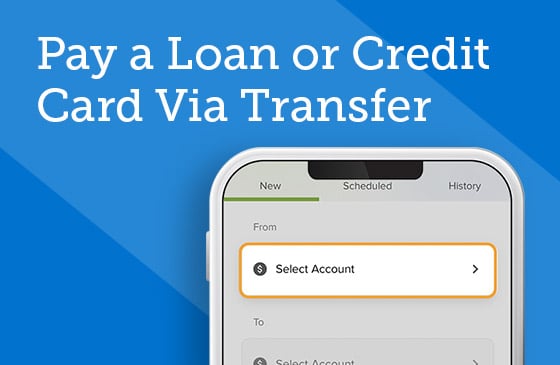

Pay a Loan or Credit Card Via Transfer

Set recurring payments or send one-time installments to your SELCO loan(s).

Make a Loan Payment With a Card

Use a debit or credit card from an external institution to make loan payments.

Request a Skip Payment

Request up to two skip payments over a rolling 12-month period on your qualifying SELCO loans.

Make a Mobile Deposit

In just a few steps, deposit checks into one of your deposit accounts using your device’s camera.

Update Multiple Payments at Once

A convenient place to designate your SELCO card to be used for payments to merchants.

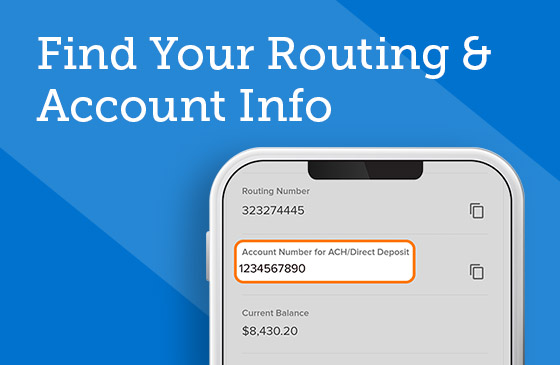

Find Your Routing & Account Info

Quickly locate SELCO’s routing number and your account information.

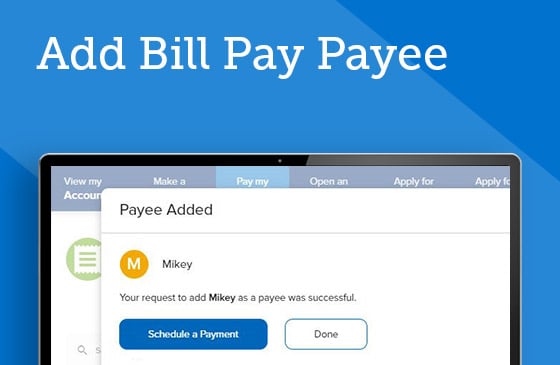

Add Bill Pay Payee

Organize your bills by setting payees through the Bill Pay function of digital banking.

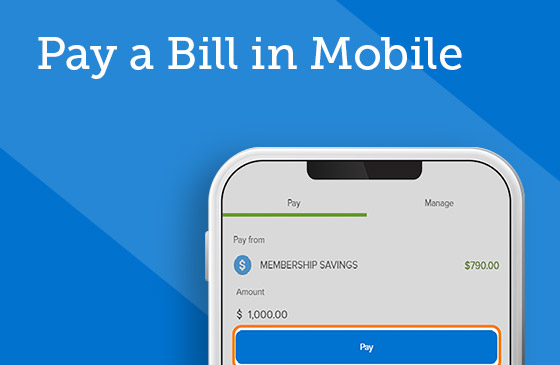

Pay a Bill in Mobile

See how easy it is to pay your bills using Bill Pay from your mobile device in digital banking.

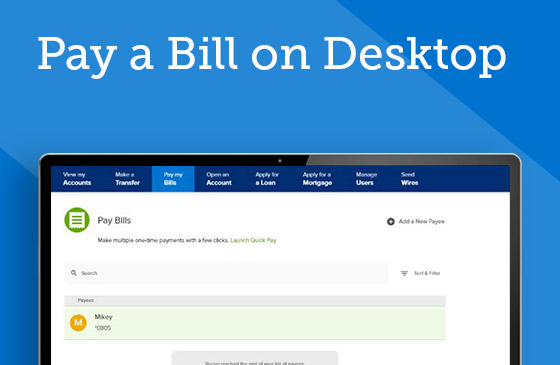

Pay a Bill in Desktop

Quick and simple steps on how to pay your bills on your desktop computer in digital banking.

View Scheduled Bill Payments and History

Get a full accounting of bills that have gone out and will go out.