Security & Privacy

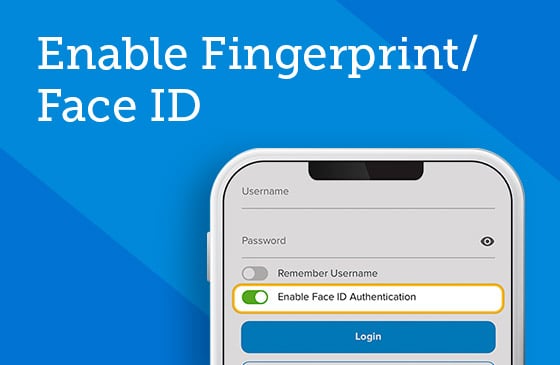

Enable Fingerprint/Face ID

Log in to digital banking without having to use your credentials.

Create Advanced Card Alerts

Receive notifications when certain transactions are made and your card is declined.

Add Login Security Validation

Enable additional security validation for your account for an extra layer of security.

Change Username & Password

Check out these simple steps for changing your username and password.

Report Card Lost/Stolen

Cancel your misplaced or stolen card and order a replacement within seconds.

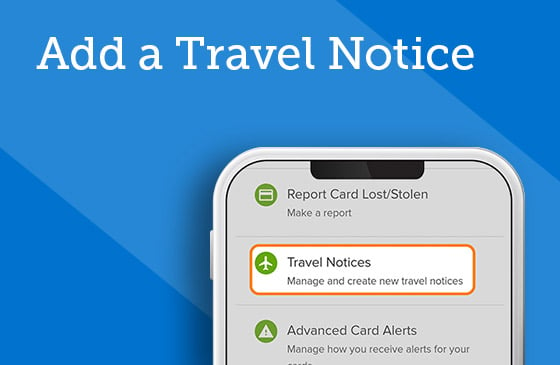

Add A Travel Notice

Enter trip details, like where you’re going and how long you’ll be gone, to prevent declines.

Set Transaction Alerts

Receive email or text alerts when checks clear, loans are coming due, suspicious activity occurs on your account, and more.