Why Choose SELCO?

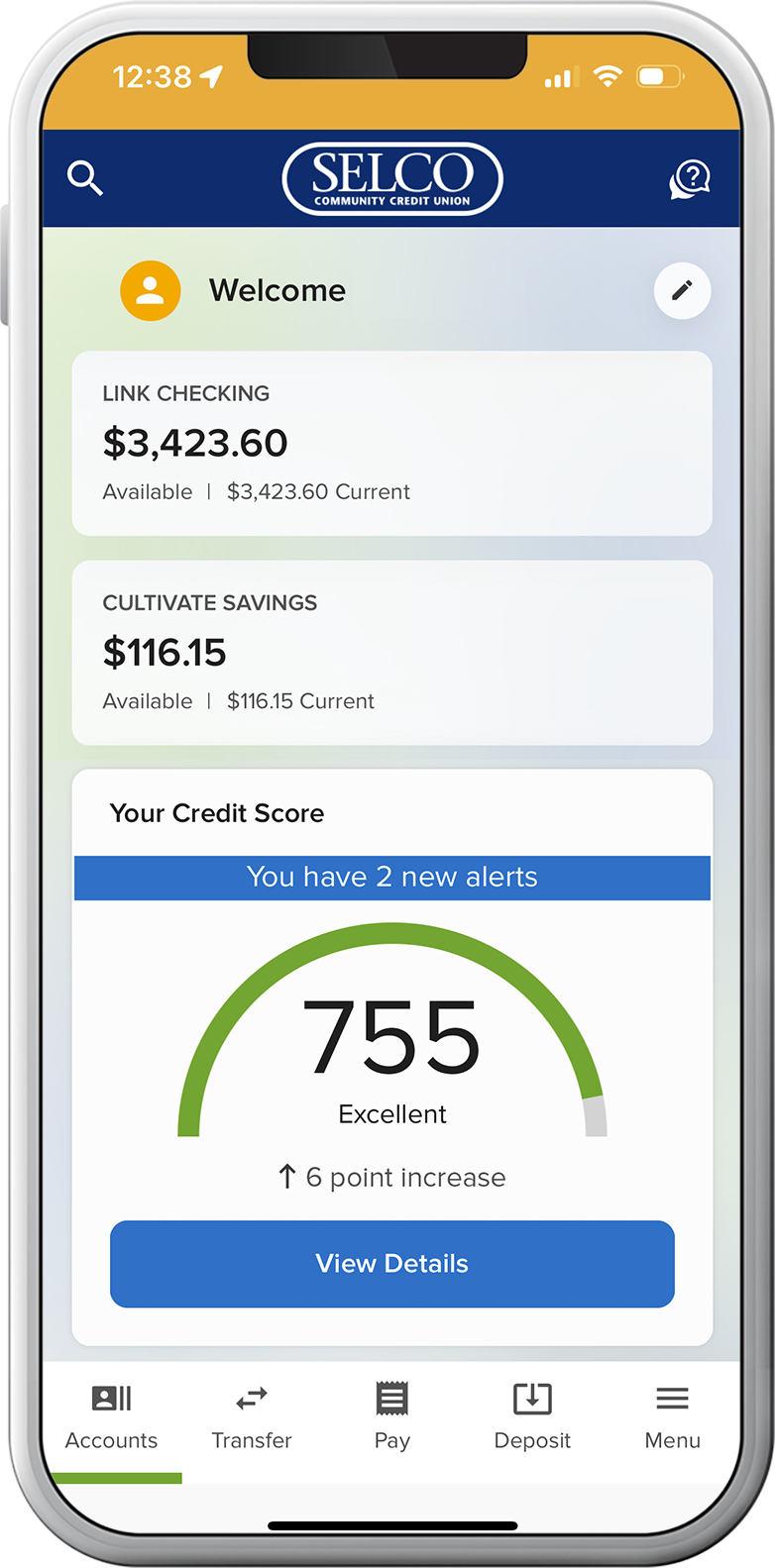

One app, your full financial picture

Easy access to all your accounts

Access all your SELCO accounts from a single login. You can even connect external accounts to send money to your SELCO accounts and loans.

Mobile wallets and card controls

Add cards to your mobile wallet and fight fraud by turning your cards off/on, setting spending limits, creating transaction alerts, and more.

Payments and transfers

Manage your bills in one central location by scheduling one-time or recurring transfers to companies and individuals.

Free credit monitoring

See your credit score in real time. You’ll even get personalized feedback on ways to boost it.

Card Controls

Spending and Goal Tracking

Credit Score Monitoring

Mobile Wallet

Access your accounts wherever you are

- 15 Oregon locations, including six branches in the Eugene-Springfield area and five in and around Bend.

- Easy-to-use mobile app, featuring mobile deposit, savings trackers, spending forecasts, and everything else you need to do your day-to-day banking.

- 30,000+ free ATMs nationwide through our CO-OP ATM Network.

All your financial needs in one place

- Checking accounts that pay you back.

- Savings and youth accounts that grow your money faster.

- Vehicle, home, business, and personal loans for whenever you’re going.

- Business banking accounts and services for all business types, sizes, and needs.

- A range of investment products for short- and long-term goals.

- Independent insurance agents who will shop for the best rates across multiple carriers.

- Free and confidential consultations with certified financial counselors.