Checking Accounts

Link Checking

A digital-first account that matches up to $7/month on your round-up savings when you meet basic requirements.

Select Checking

A full-featured, traditional account perfect for those who want checks, mailed statements, or an interest-bearing checking option.

Elevate Checking

A credit-builder account to help develop strong financial habits on the way to full-service checking.

Compare checking accounts

| Features | Link Checking | Select Checking | Elevate Checking |

|---|---|---|---|

| Monthly service charge | None | None | None |

| Round-up savings option on card purchases |

|

|

|

| Earn up to $7/month in round-up savings matches |

|

|

|

| Interest-bearing option available |

|

$5 monthly fee; waived with $500 min. balance. |

|

| Printed statements available |

|

|

|

| Paper checks available |

|

|

|

| Non-sufficient funds fee | None | $25 per occurrence | None |

| Automatic overdraft transfer fee | None | $3 per occurrence | None |

| Courtesy pay fee | None | $25 per occurrence | $10 monthly for optional coverage |

| Out-of-network ATM fee | None | $1 per use | $1 per use |

| Find out more | Learn More | Learn More | Learn More |

| Account Type | Monthly service charge | Round-up savings option on card purchases | Earn up to $7/month in round-up savings matches | Interest-bearing option available | Printed statements available | Paper checks available | Non-sufficient funds fee | Automatic overdraft transfer fee | Courtesy pay fee | Out-of-network ATM fee |

|---|---|---|---|---|---|---|---|---|---|---|

| Link Checking | None |

|

|

|

|

|

None | None | None | None |

| Select Checking | None |

|

|

$5 monthly fee; waived with $500 min. balance. |

|

|

$25 per occurrence | $3 per occurrence | $25 per occurrence | $1 per use |

| Elevate Checking | None |

|

|

|

|

|

None | None | $10 monthly for optional coverage | $1 per use |

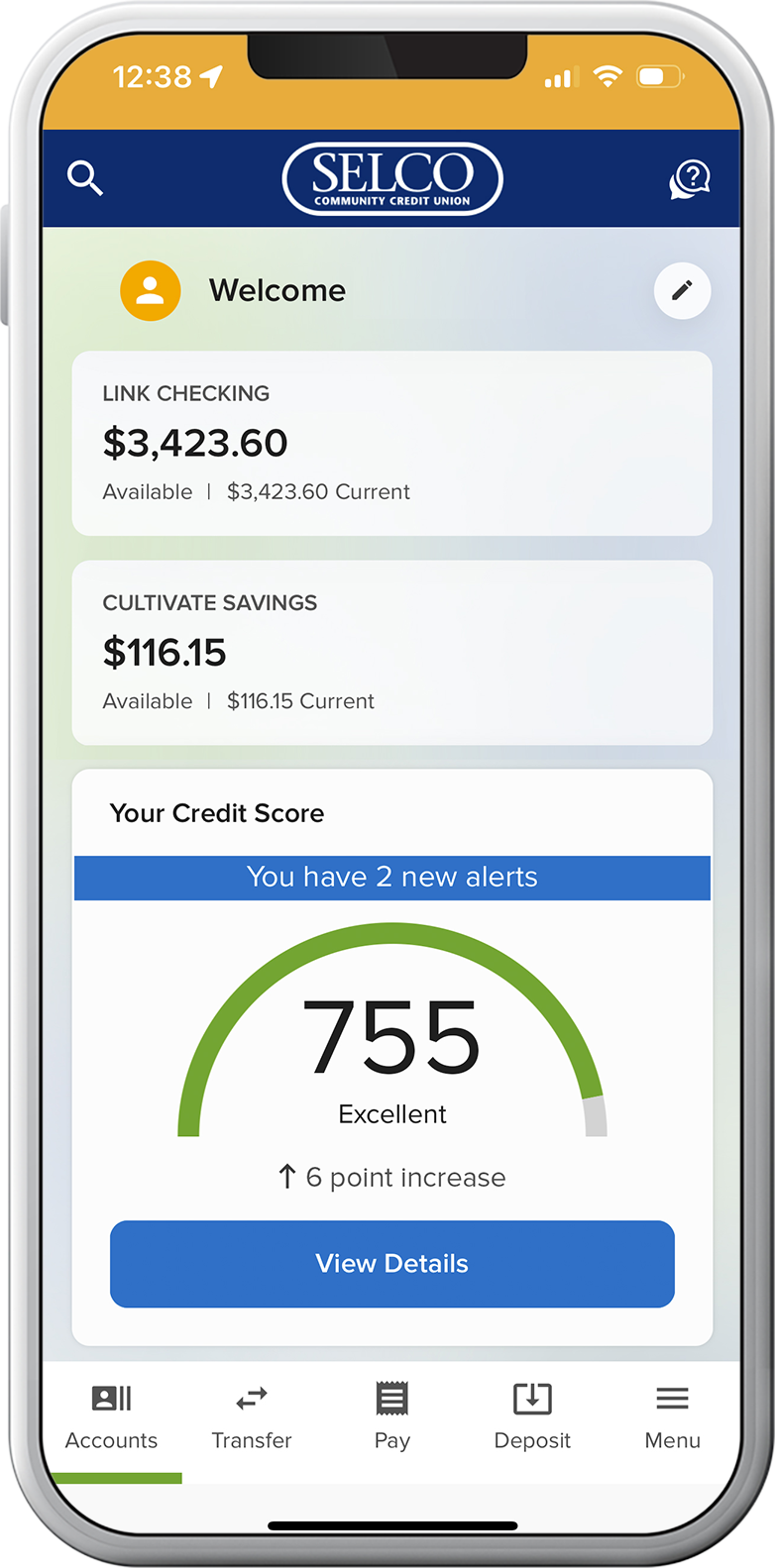

A better banking app

Complete your day-to-day transactions and more—securely from wherever, whenever.

Mobile wallets and card controls

Add cards to your mobile wallet, turn cards off/on, set spending limits, create transaction alerts, and more.

Payments and transfers

Easily connect your SELCO and other accounts to securely transfer money.

Free credit monitoring

See your credit score in real time. You’ll even get personalized feedback on ways to boost your score.

I've been a SELCO member for four years, and they still continue to impress! The employees are always friendly and treat you more like family than an account holder. I’ll never go anywhere else.

Switch to SELCO (the easy way)

Ready to switch to SELCO from another institution? ClickSWITCH removes the hassle. Update your direct deposit, automatic payments, and subscription account information in just a few steps.